UX/UI | Growth Case Study

– Mortgage Works

Simplifying the Mortgage Journey. A User-Centric, Mobile-First Website Redesign for Mortgage Works.

My Role

Solo UX/UI Designer

Year (s)

2023 - Sydney, Australia.

Tools

Figma, WordPress, Elementor & Adobe Creative.

Website

mworks.com.au

Overview

Mortgage Works is an Australian mortgage broker company that offers personalised loan solutions.

The Mortgage Works website is the primary touchpoint of the user’s journey, providing information about the company, their services, mortgage options, and contact information. However, their previous website had not been updated in several years and didn’t meet the company’s and its customers’ needs.

Outcome

The new Mortgage Works’ website has a user-friendly interface that is easy to navigate and provides users with relevant information. It is optimised for tablet and mobile devices and reflects the company’s professional brand identity.

The mortgage calculator, information on mortgage options, and easy-to-use contact form provide users with the necessary information and tools to take action. The website design increased user engagement and leaded to higher conversion rates as expected.

The Process

Understanding Mortgage Works & its users

Research Summary

To understand the pain points and needs of the Mortgage Works website's users, we conducted a series of research activities, including:

User interviews

We conducted interviews with past and potential customers to understand their experiences with the current website and identify pain points and areas for improvement.

Competitor analysis

I analysed the websites of other mortgage broker companies to identify best practices, patterns and design trends that could be applied to the new Mortgage Works website.

Analytics review

We reviewed the website's analytics data to gain insights into user behaviour and identify areas where users were dropping off or experiencing issues.

Research Results

Pain Points of Previous Website Users

Difficult to navigate

Users had trouble finding the information they needed, with a confusing site structure and inconsistent navigation.

Outdated design

The site's design was outdated and did not reflect the company's professional brand identity.

Limited mobile optimisation

The site was not optimized for mobile devices, which could deter potential customers from engaging with the company.

Persona

First-time home buyers looking for personalised support and guidance throughout the home buying process.

Goals

Work with a trustworthy company that will provide personalised service and support throughout the process.

Find a mortgage with competitive rates and terms

Find a mortgage broker that can help her navigate the home buying process.

Get pre-approved for a mortgage so that she can start shopping for a home

Pain Points

Overwhelmed by the many different mortgage options available

Concerned about finding a trustworthy company to work with.

Wants to ensure that she is getting the best mortgage rates and terms.

Needs personalised support and guidance throughout the process.

Behaviours

Researches online before making any decisions.

Prefers to work with companies that have a professional and trustworthy image.

Values personalised service and attention to detail.

Willing to pay more for a higher level of service and support.

Prototyping: User Flow

The website offers users personalised support and guidance throughout the mortgage process, providing various convenient channels for them to get in touch with a mortgage broker, including phone, email, online forms, and click-to-call buttons.

Wireframes / User Flow – Lead Conversion Process

The Result

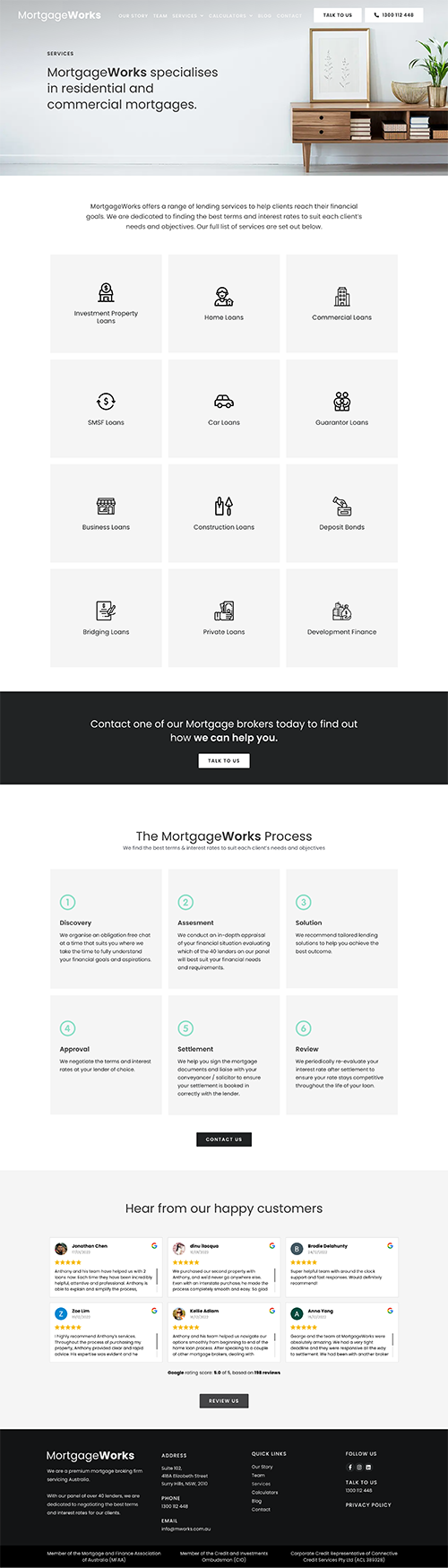

Functional, User Friendly & Easy to Navigate Interface

Users can quickly and easily find the information they need

By simplifying the information architecture and navigation, users can easily find the information they need without feeling overwhelmed, leading to a more engaging experience.

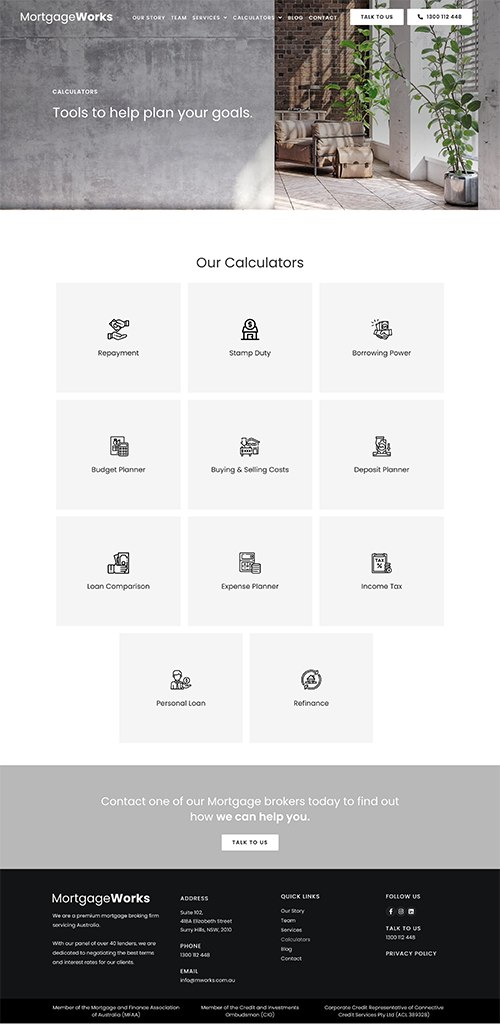

Empowering users to make informed mortgage decisions

By incorporating improved functionalities, users can conduct online research, estimate mortgage payments and costs using calculators, and be pre-approved for a mortgage using simplified forms.

Allow users to easily apply online through a simple and targeted form that can be completed in a few steps.

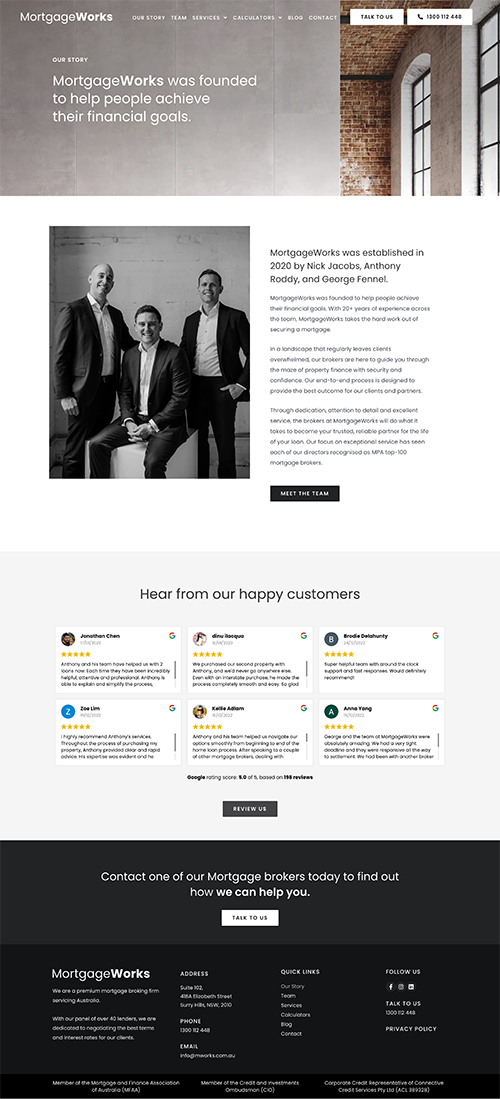

Professional and

Trustworthy image

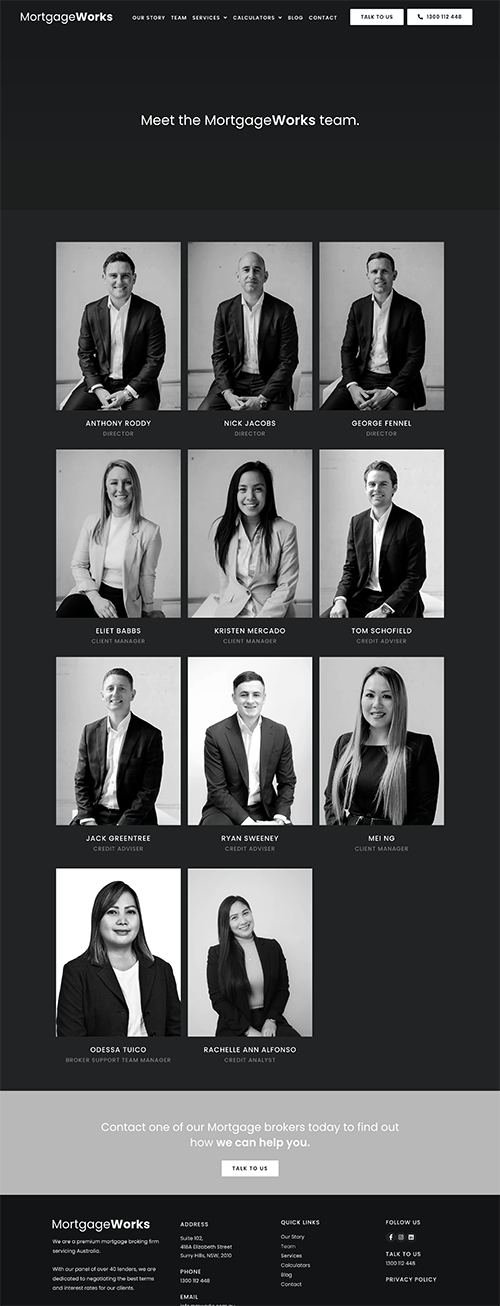

I build credibility by showcasing the company's human side by including real pictures of team members, highlighting the company's values and commitment to customer service, and displaying real-time customer reviews and testimonials on the website.

Mortgage Works values page

Mortgage Works navigation menu

Usability & Accessibility improvement

Incorporating icons into the design help users understand the interface and the information more easily.

Real-time testimonials

DIY Mortgage Estimations. Includes interactive tools, such as mortgage calculators, to help users estimate their monthly payments and total costs.

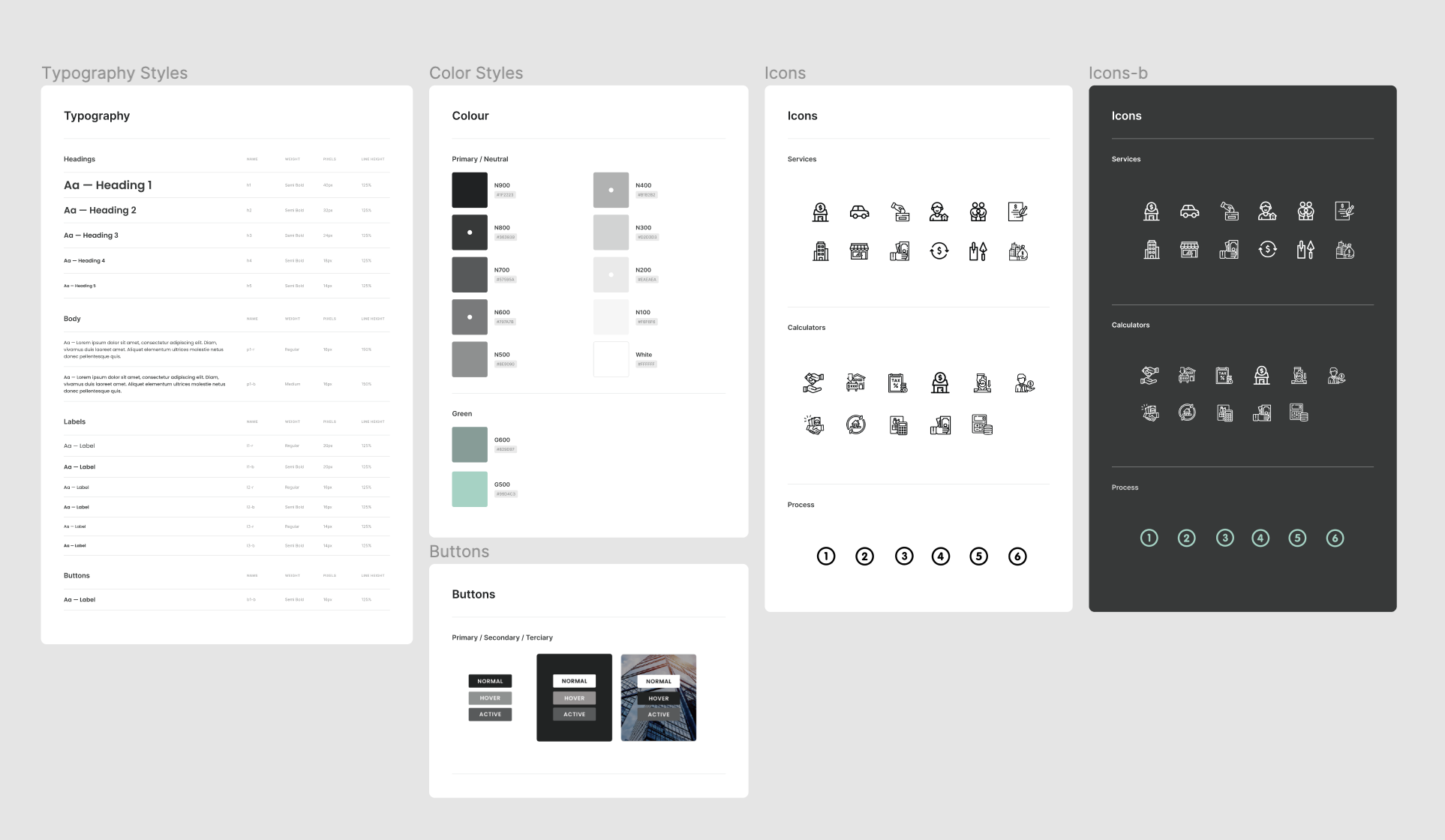

New Design System (UI)

The new comprehensive design system ensured consistency and efficiency in the design process.